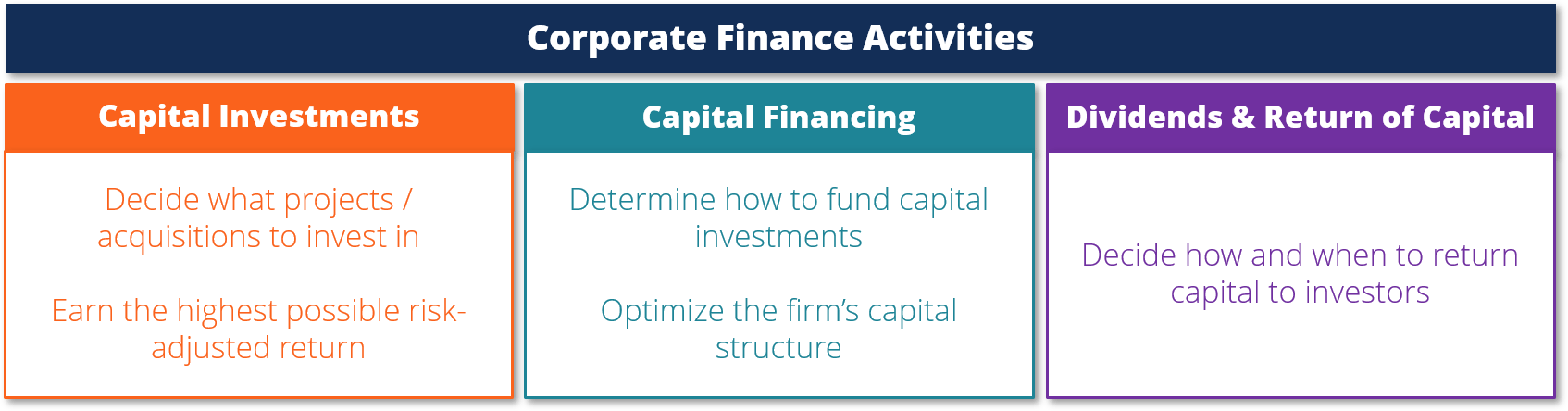

Corporate finance is a subfield of finance that deals with how corporations address funding sources capital structuring accounting and investment decisions. Corporate finance is the area of finance that deals with the sources of funding and the capital structure of corporations the actions that managers take to increase the value of the firm to the. Updated Jul 08 2023 Venture Debt Financing What Is It and How Does It Work Meaning History What Are Capital Markets and How Do. Corporate finance encompasses the strategies tools and structures that enable corporations to grow from startups to large and powerful enterprises. Corporate finance is the process of obtaining and managing finances in order to optimize a companys growth and value for its shareholders The concept focusses on investment financing and..

Corporate finance is a subfield of finance that deals with how corporations address funding sources capital structuring accounting and. Corporate finance is the area of finance that deals with the sources of funding and the capital structure of corporations the actions that managers take to. Corporate finance deals with the capital structure of a corporation including its funding and the actions that management takes to. Corporate finance deals with financing capital structure and money management to help maximize returns. Corporate finance is the process of obtaining and managing finances in order to optimize a companys growth and value for its shareholders..

..

Free Cash Flow Cash from Operations CapEx Free cash flow is one measure of a companys financial performance It shows the cash that a company can produce after deducting. This is the ultimate Cash Flow Guide to understanding the differences between EBITDA Cash Flow from Operations CF Free Cash Flow FCF Unlevered Free Cash Flow and Free Cash Flow to Firm. FCFF or Free Cash Flow to Firm is the cash flow available to all funding providers debt holders preferred stockholders common stockholders convertible bond investors etc. Free Cash Flow to Equity FCFE FCFE represents the cash thats available after reinvestment back into the business capital expenditures Free Cash Flow to the Firm. Lets look at how to calculate Free Cash Flow to Equity FCFE by examining the formula It can easily be derived from a companys Statement of Cash Flows..

:max_bytes(150000):strip_icc()/corporate-finance-Final-90e2e40f344a456c8cd371f226cfa6b4.jpg)

Comments